A new dawn

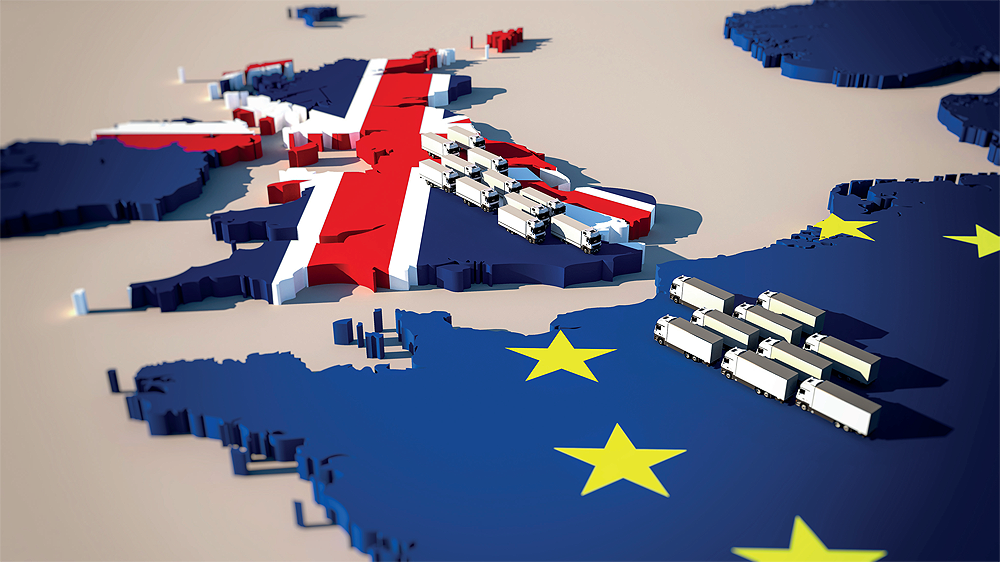

As the food and beverage industry emerges into the post-pandemic era and looks to increase export opportunities across the world, what risks must be managed? Alex Price looks at the currency side of this issueIt’s been almost four months in lockdown [at time of writing] and Covid-19 has been one of the biggest challenges the food and drink industry has faced. The sector has certainly had a lot on its plate, but it hasn’t stopped members of the industry pulling up their sleeves and continuing to feed the nation.Food and drink companies are invaluable to the UK economy, adding a value of £21.5 billion as the largest single manufacturing sector. And, although the UK may only represent three per cent of global GDP, we punch well above our weight in terms of entrepreneurial talent, ambition and drive, a feat demonstrated by the food and drinks sector’s propensity to dig deep over the last four months.As the nation emerges post-pandemic, the industry’s insatiable appetite for growth will be a key ingredient to economic recovery. The UK Global Tariff signals a new dawn for exporting the Best of British to new markets and new customers.However, opportunities on the international stage will present their own challenges, which require greater attention to risk in order to prevent currency costs unnecessarily biting into a businesses’ bottom line. With all this market movement, there are some key things to keep in mind in order to mitigate currency risks:Shoring up your supply chainsCovid-19 has led to unprecedented supply chain disruption, and we aren’t out of the woods yet. Expect further challenges as the UK navigates Brexit and beyond. As a significant proportion of supply in the sector is imported, changes in supply means that local importers will need to pay greater attention to their currency hedging profiles as they forge new supply contracts, by fine turning their notional and forward hedges.US-China trade war, how will it affect UK businesses?As the trade war between the US and China continues to impact the exchange rate, this is creating uncertainty and potential volatility for clients with China supply lines. The US Dollar/Chinese Yuan exchange rate is a crucial negotiating chip in the US-China trade war. Because the People’s Bank of China heavily manages the exchange rate, the trade war, and its politics, are a major determinant of the exchange rate movement, as opposed to the market conditions that would usually apply in a free-floating currency.Uncertainty over the exchange rate and the imposition and cost of trade tariffs makes fluctuations in the exchange rate very difficult to predict and manage for all parties involved in the supply chain, potentially affecting contracts negotiated in USD or CNY.Brexit – deal or no deal, do or die?As we enter, what appears to be the final negotiations, it looks as though the UK will be leaving the EU on 31st Dec with or without a deal. The implications will be felt far and wide in the food and drink sector, as over 30 per cent of UK food is imported from Europe. With the final negotiation of the free movement of goods and services still uncertain, continued volatility for the GBP/EUR currency pair looks likely to continue.As businesses plan for the deadline, they should look to take a dynamic approach to their FX risk hedging. In particular businesses will not want to become over hedged should supply chain become disrupted. Flexibility is key here. Mirror uncertainty by managing risks through under hedging or by using options-based strategies.But with risk, comes opportunityFrom small local producers, to famous global brands and quality products such as British beef, seafood, whisky and English wines, beers and spirits – British manufacturers are world-class innovators. They have cutting edge technology and a lot to showcase.Increased global demand for organic, ethical, high quality and artisanal food is helping feed the success of the UK’s food and drink industry. Statistics reported by HMRC, show the UK exported nearly £24 billion worth of high-quality food and drink, up by 4.9 per cent on the previous year and up by over 18 per cent since 2016.It’s important to start keeping track of bilateral trades deals with growing powerhouses such as China, India Japan, and Brazil, where the ‘Best of British’ retains a strong cache with consumers. Moreover, buying abroad can help to cater for the trend of meat free diets. Brazil for example, grows jack fruit, which makes a great meat substitute, and is the second biggest food producer behind the US.Each powerhouse has their own unique challenges: emerging market currencies will be more volatile, and their restricted nature means there can be high information hurdles and costs when transacting in restricted currencies on shore. Look for FX providers that have local onshore banks, as this will help facilitate local FX transactions, quickly and at a good cost.Being attuned to market movements will help businesses to save on currency, which means having the capital to invest further growth and other areas of a business in the long run, for example consumer experience and good environmental practice. Savings will enable companies to not only build back – but build back better.Here’s a step by step process how:Step one: Understanding currency exposureBusinesses need to take a look at their balance sheets and consider what fraction they are of overall incoming and outgoing funds because this will indicate the measure of risk. From there, a consideration needs to be made, looking at where the market may be growing or shrinking and where the future opportunities lie.Step two: Establish a dynamic hedge strategyAn FX hedge programme should not be static, and should be constantly evaluated against budget rates, changes in nominal value of contracted delivery and changes in timelines or commitments. A strategy should include products that balance a need for flexibility and protection, for example forward contracts will remove risk and offer greater protection, but options structures will allow you to be flexible and benefit from a beneficial movement in the market. Dynamism will ensure that during times of supply line disruption, business interruption or heightened FX volatility, businesses do not become over or under hedged.Step three: Speak to a specialistCurrency specialists typically offer better rates and lower fees than high street banks. Specialists offer the benefit of expert guidance from individuals who not only understand the foreign exchange market but also the challenges of producers and manufacturers within the food and drink industry.Alex Price is Head of London Outbound Sales at moneycorp. The moneycorp group serves the growing foreign exchange and payments needs of global businesses, importers and exporters, online sellers and personal clients. Headquartered in London, with a worldwide presence, moneycorp prides itself on providing exceptional customer service. A global company with local expertise.www.moneycorp.com/en-gb/