Thomas Hardy Holdings Expands Capacity Amid Premium Spirits Boom

Spirited growth

Major investments in its packaging plants have extended Thomas Hardy’s capacity, as the brewing and bottling business capitalises on the ongoing premiumisation in the spirits’ market

The support Thomas Hardy Holdings has continued to provide to its renowned customers in the brewing and bottling segments of the beverages market, has made for a successful last three years for the company. It was in March 2017 that FoodChain first introduced the family-run business to our readers and, in the time since, Thomas Hardy has experienced further growth. According to Managing Director, Chris Ward, it has been driven mainly by the trend of premiumisation that has emerged in the marketplace, as well as by the strong results the company’s clients themselves have posted.

“We can see that consumers are becoming more selective and more quality-orientated when they purchase alcoholic beverages. While they do not necessarily spend more money in total, they tend to spend more per unit and just buy less units. This kind of premiumisation favours us, because we are positioned at the higher end of the market and have the expertise that allows us to serve customers’ needs in this space,” Chris discusses.

“The evident resurgence of gin and tonic, particularly craft gin and premium tonics, which, together with the ever-expanding craft beer market, has bolstered our growth,” he adds. “And because the market has been buoyant, our customers have enjoyed a period of success, too. That influenced our decision to make a significant investment at our two plants and increase our capacity, in order to be able to continue to support them.”

Changing drinking habits

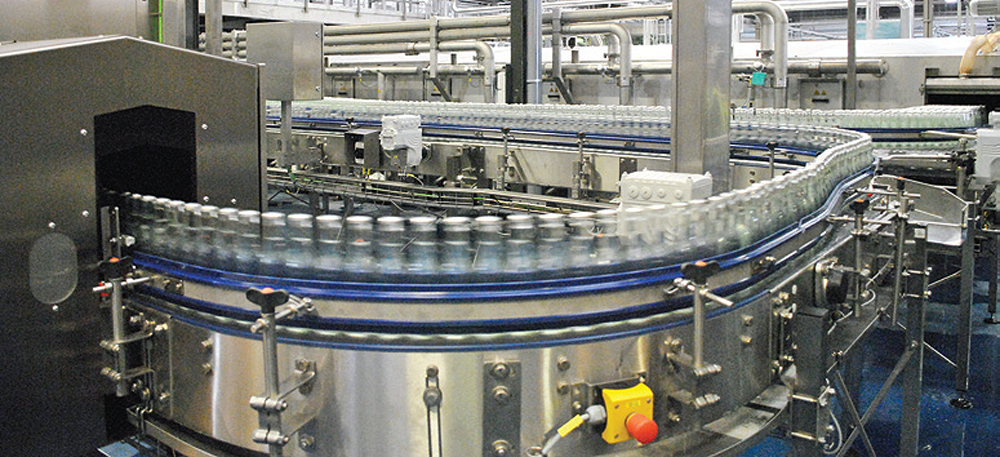

In excess of £16m was spent by Thomas Hardy in 2019 across both its packaging facilities – in Burtonwood and Kendal. A considerable part of the sum was used to build a 1000-square-metre extension to the Burtonwood facility, which enabled the company to put in a new line that replicated the layout of the existing two lines.

Chris goes on: “We installed new ACMI depalletisers and Krones fillers in both Burtonwood and Kendal. Our original filler in Kendal was 42 years old and was due for renewal, and the new technology we brought in has improved quality in aspects like fill levels, dissolved oxygen control and carbonation control. For the new line in Burtonwood, we have also gone for a pasteuriser and a labeller from Krones. In fact, we became the first UK company to install their Ergomodul labeller capable of doing both wet glue and PSL labelling on the same machine, which has proven to be a great success. Finally, we installed packers from Aetna, which we run on our other two lines.

“It is worth mentioning that getting the extension facility up and running was a major undertaking and all credit needs to go to our team, our suppliers, our builders City Build and the other contractors such as Suez, who completed our water treatment plant. They all did a brilliant job. It has created the extra capacity we needed, which we will now be looking to fill in the coming years, so that we can continue our growth projections.”

In planning its strategy for the future, Thomas Hardy has taken into account the fact that millennials are radically changing their drinking habits. Chris even cites figures showing that up to 30 per cent of young people are teetotallers. “Initiatives like Dry January and Go Sober for October are only going to attract more people in the future, but at the same time, we can see that consumers still want to spend their disposable income at the end of the month on quality drinks. Therefore, we will be keeping a close eye on the market for low-alcoholic or non-alcoholic beverages, where we anticipate opportunities will be springing up in the next couple of years.”

Chris is also conscious that becoming more environmentally-friendly will be another important factor at play across the industry. “On an internal level, we are striving to be as energy efficient as possible and we have recently put in new compressors and chillers, as well as new lighting, to reduce our energy usage. Added to that, the wider industry has resolved to limit the use of plastic packaging or at least to increase the amount of recycled plastics it uses. The challenge in this case will be to ensure that the plastics are recycled and utilised efficiently, here in the UK and don’t end up as landfill,” he opines.

“Historically, however, one of the biggest challenges the industry has repeatedly faced, is political intervention. Over the years, we have battled through things like the sugar tax and the pub smoking ban. In my view, facility up and running was a major undertaking and all credit needs to go to our team, our suppliers, our builders City Build and the other contractors such as Suez, who completed our water treatment plant. They all did a brilliant job. It has created the extra capacity we needed, which we will now be looking to fill in the coming years, so that we can continue our growth projections.”

In planning its strategy for the future, Thomas Hardy has taken into account the fact that millennials are radically changing their drinking habits. Chris even cites figures showing that up to 30 per cent of young people are teetotallers. “Initiatives like Dry January and Go Sober for October are only going to attract more people in the future, but at the same time, we can see that consumers still want to spend their disposable income at the end of the month on quality drinks. Therefore, we will be keeping a close eye on the market for low-alcoholic or non-alcoholic beverages, where we anticipate opportunities will be springing up in the next couple of years.”

Chris is also conscious that becoming more environmentally-friendly will be another important factor at play across the industry. “On an internal level, we are striving to be as energy efficient as possible and we have recently put in new compressors and chillers, as well as new lighting, to reduce our energy usage. Added to that, the wider industry has resolved to limit the use of plastic packaging or at least to increase the amount of recycled plastics it uses. The challenge in this case will be to ensure that the plastics are recycled and utilised efficiently, here in the UK and don’t end up as landfill,” he opines.

“Historically, however, one of the biggest challenges the industry has repeatedly faced, is political intervention. Over the years, we have battled through things like the sugar tax and the pub smoking ban. In my view, the next big issue will be the Deposit Return Scheme (DRS) that the Scottish Parliament is hell-bent on introducing, which will ultimately have to be adopted by the UK too.” Chris continues, before detailing the nature of his concerns.

“It is a no brainer that everyone is in support of increasing and improving our recycling practices. What I feel, though, is that a lot of the unintended consequences that will follow from putting the DRS in place, have not been explained clearly to the public. For example, the substantial costs associated with implementing the scheme will ultimately be passed on to the consumer. What is more, there will always be unreturned bottles, which means that people will not get their deposit back, and this will further affect their buying power.”

Adapt to change

He also considers the possible effects the DRS might have on the existing kerbside collection system: “We have one of the best kerbside collections in Europe. The question is, what will happen to those collectible items that are not included in the DRS, such as plastic food containers, if a material element of the income derived from key recyclable materials (aluminium & glass) is removed? All in all, a lot of questions are left unanswered and when you add to this the incredibly tight timeframe the Scottish Government are looking at for implementing the scheme, you cannot help but think that the process could end up being rushed and could have been better thought-through. Maybe we could reach a more sensible solution and simplify the system by possibly excluding glass from it. As, however, the political will is that it is included and as the legislation is to come into effect shortly, we have to prepare as best as we can and think of as many of the actions we need to take, to adapt to the impending change.”

Throughout its history, challenges have come and gone and Thomas Hardy has built a solid record of overcoming any issues that may hamper its growth. Consequently, the company has every reason to maintain its confidence that its future endeavours will continue to meet with success. In conclusion, Chris reveals the organisation’s key objectives for the upcoming three-to-five-year period: “Growing alongside our existing customers, while also expanding our client base is what we are aiming for. This includes targeting the low-alcohol and alcohol-free sectors, and finding businesses within these that we can support with our services. By doing so, we will get closer to realising our ultimate goal of moving our output north of 25m cases per year.”